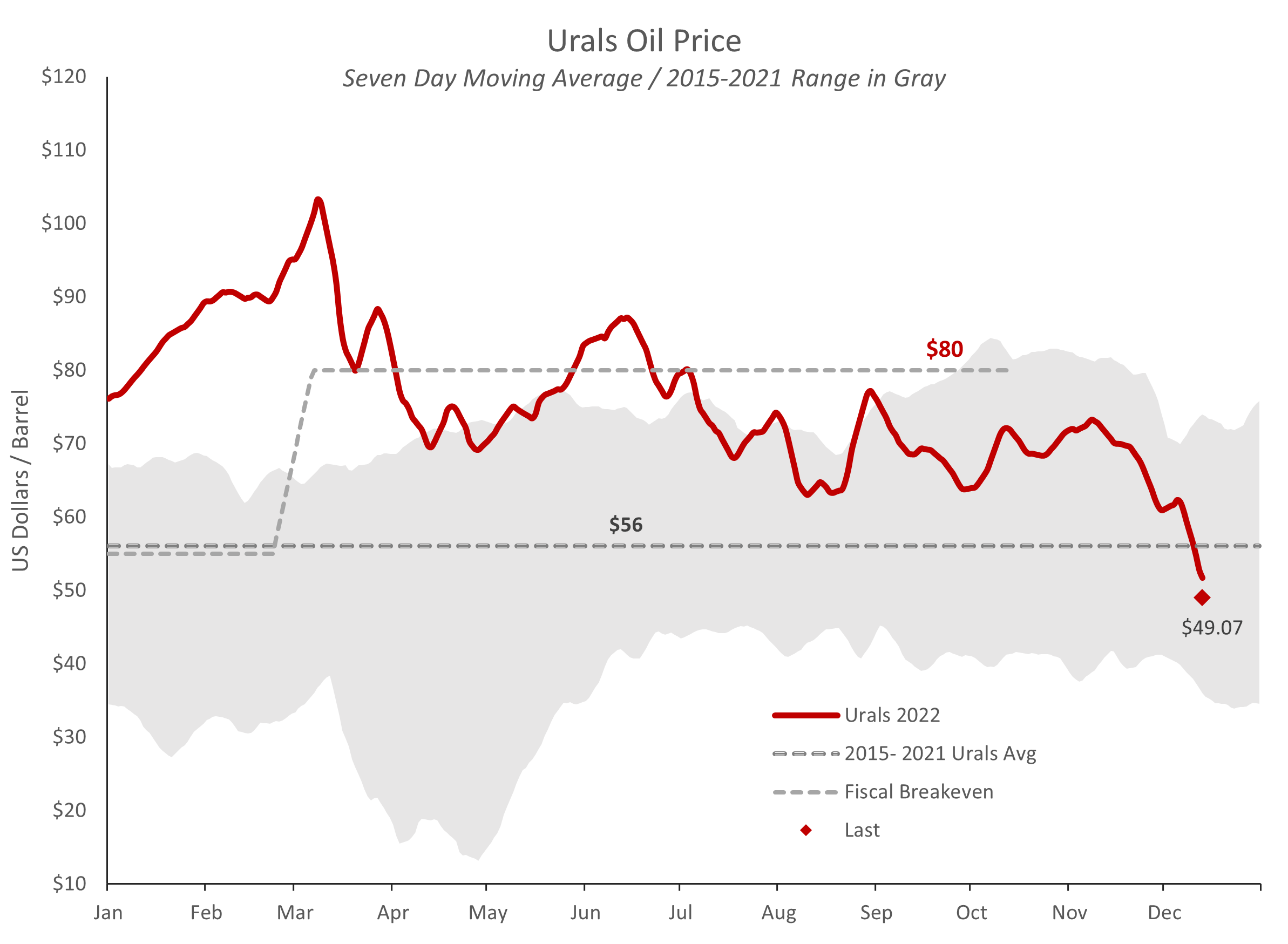

A couple of graphs on Russian oil prices (Urals-Brent) and the Urals Discount.

The published Urals price -- the price Russia receives for oil exports towards Europe -- has collapsed to under $50 / barrel. This is $7 / barrel below the average Russia received during the 2015-2021 period, when Urals averaged about $56 / barrel. We place the fiscal breakeven for Russia at around $80 / barrel in September, as that is the point at which Putin called for production cuts. That is, when Urals fell back below $80, Moscow was looking for price support. Therefore, based on observed behavior -- not a calculation of Russian budget requirements -- we can make a case for an $80 Urals fiscal breakeven for Russia in September. In our view, this breakeven has probably risen since then, perhaps materially (and our breakeven assumes normal levels of oil and gas exports from Russia).

Source: Oilprice.com, EIA, Prienga analysis

The Urals Discount is the difference between the European benchmark Brent oil price and the Urals-Brent oil price Russia receives for Europe-bound exports. The Discount did not visibly increase from recent levels of $23 / barrel in the first week of the Cap. However, it is important to note that Urals prices are released with a delay and only a few times per week, and therefore published prices may not reflect market realities in the very short term.

Yesterday opened with the Discount rising to $29 / barrel, suggesting that Russia is struggling to find buyers for its western crude exports.

Source: Oilprice.com, EIA, Prienga analysis

I will have more on this topic later. For now, I think it important to note that our analysis does not preclude a complete collapse of Russia's western crude exports to the extent Russia cannot place them on its own and allied 'Shadow Fleet'.

The western supply chain -- the shippers, insurers and the rest -- may decide to avoid the Russian business altogether. Were I a P&I insurer, I would walk away from the Russia business without a thought if it were less than, say, 10% of my revenues. Not worth the risk and hassle. Without insurance, the tankers will not move the crude, and the Baltic and Black Sea trade will collapse to the extent Russia is unable to ship the oil on its own and allied vessels.

Moreover, it would seem suicidal for Putin to acquiesce in the Price Cap, as that can only lead to worse later. Were I the Russians, I would continue production, but drain the excess crude into a giant pit fashioned into an appropriate symbol and set it on fire, making quite literally a flamboyant gesture visible from space. That's more the Ukrainian's style, but if Russia caves to Cap requirements, the allies will know that they have Putin right where they want him, only a few moves from checkmate.

That Russia is earning less export revenue is all good for Ukraine (although the Discount itself is a mortal threat). On the other hand, if the global economy fails to collapse, the potential for Brent to add a quick $30 / barrel is very much on the table. That won't go over well in western capitals. For that reason, cutting oil exports sharply is probably Putin's best bet.