Paul Bedard at the Washington Examiner kindly ran a piece based on my last post, here. Paul has covered my work on illegal immigration for the last several years, now preempted by my more immediate concerns with the Ukraine conflict. Also, find my editorials in Kyiv Post here.

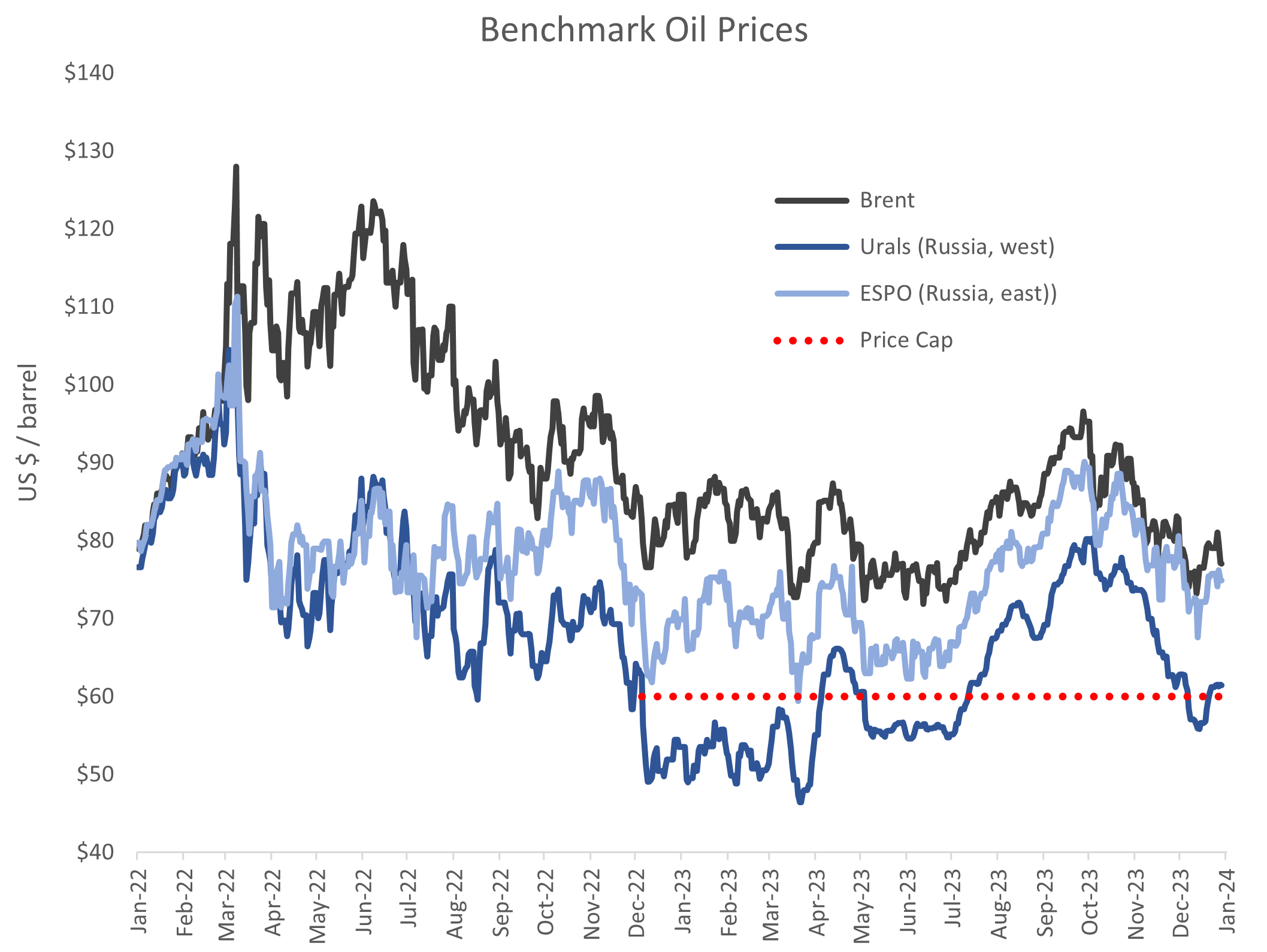

Oil Prices

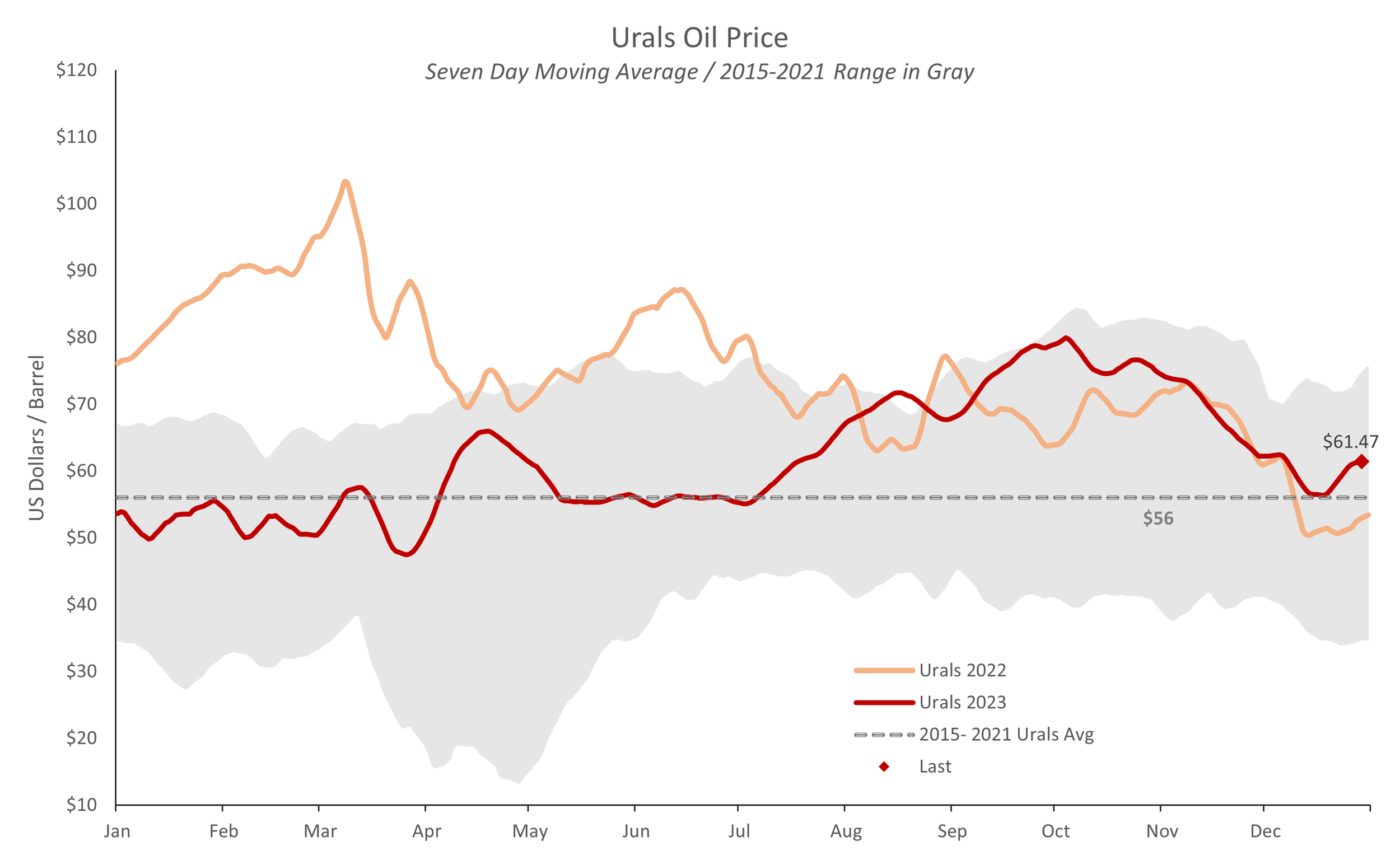

Brent closed the year at $77 / barrel, and Urals posted $61.47. Urals is marginally above the Cap limit of $60, but still well off the $71 / barrel the Russian government is budgeting to fund increased war spending in Ukraine. For now, this is positive for Ukraine.

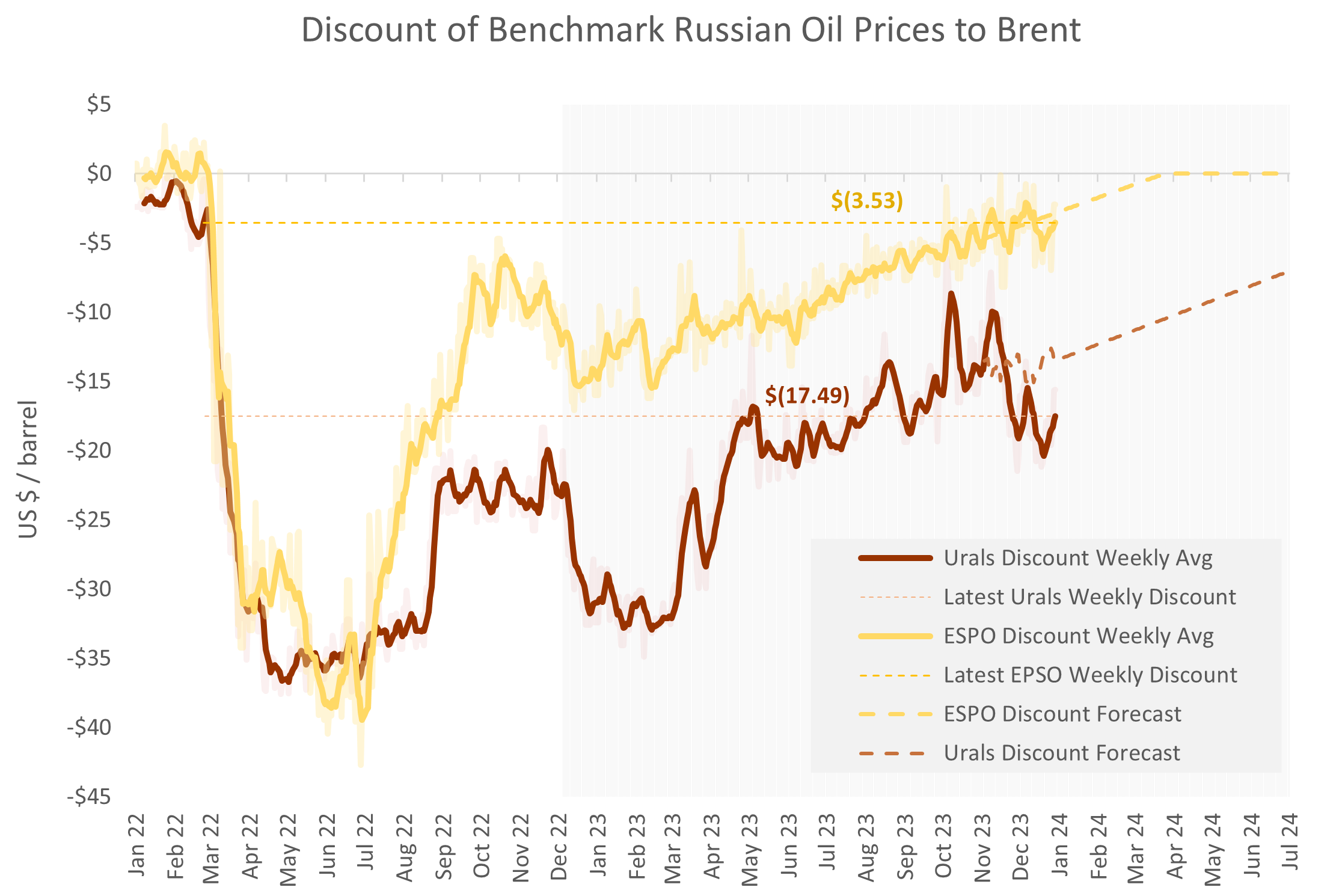

The Urals discount -- the difference between Russia's western crude oil export price and the European benchmark Brent -- closed a bit to $17.50 last Friday. This is $4 / barrel larger than our Brent price-adjusted forecast of $13.50. (The Urals discount varies with, among others, the price of Brent. The discount narrows by about $0.25 / barrel for every $1 gain in Brent. Thus, if Brent rose from its current $77 / barrel to $87, we would expect the discount to narrow by $2.50 / barrel for this reason alone. I'd note this is a low-confidence relationship with an R2 of only 0.11 on a 0.0-1.0 scale. Take it as a rule of thumb, not as a rule.)

Once again, US enforcement seems to be producing some limited effect. The discount is back in the range seen in June and July 2023, but much improved from the tight spread in October and November. Thus, enhanced US Price Cap enforcement appears to have widened the discount, but only back to the levels which prevailed before October and November. Still, it's better than nothing and positive for Ukraine overall.

Urals ended the year about $8 / barrel higher than a year ago.

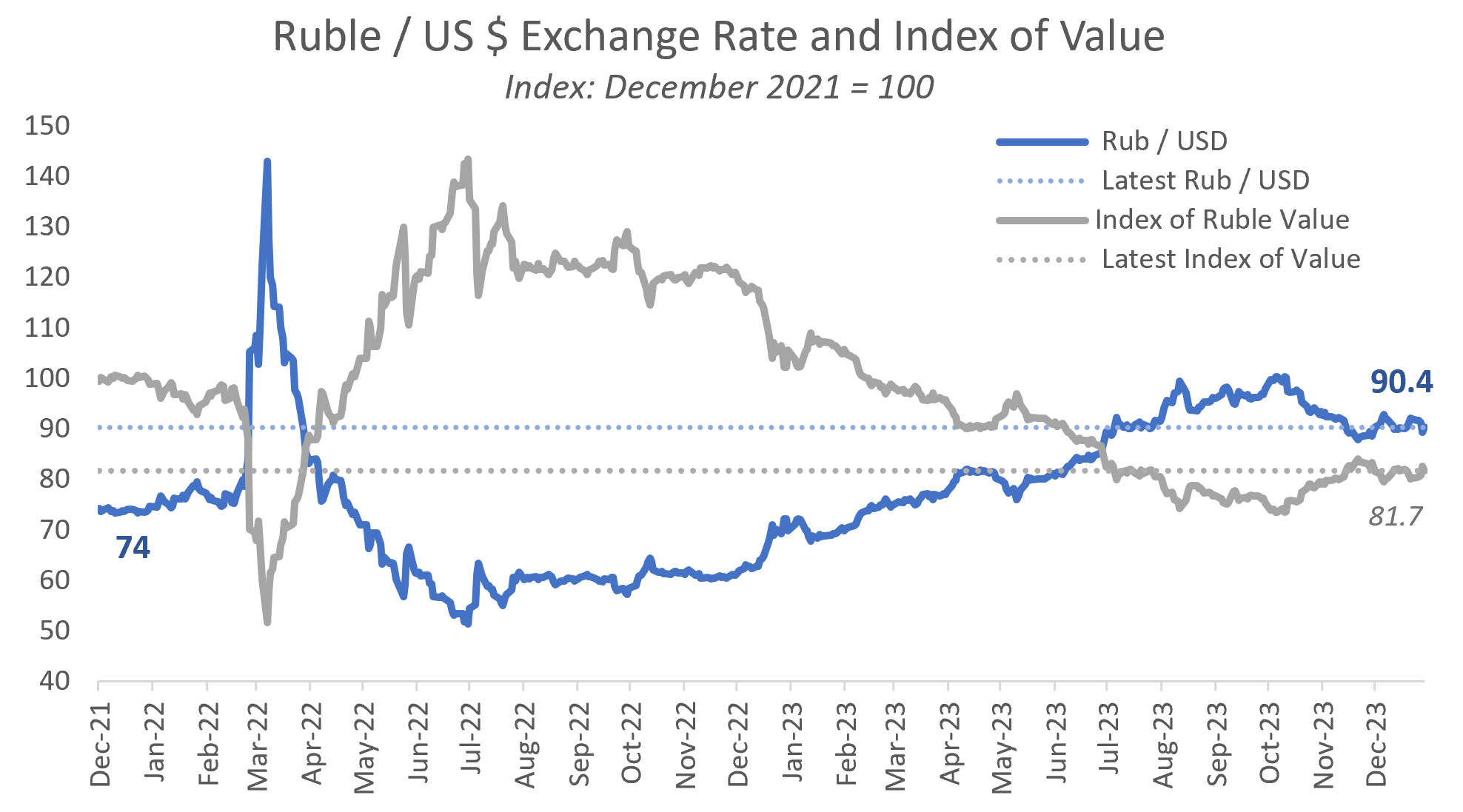

Ruble Exchange Rate

Finally, the ruble ended the year at 90.4 ruble / US dollar, largely unchanged in the last two months.

The war is settling into a kind of deadly monotony and routine, and that's visible in the statistics as well.