JP Morgan strategists see "Brent crude heading toward $100 a barrel this year without countermeasures to balance Russia’s decision to cut production". As I noted last week, Russia looks to cut production by roughly 500,000 bpd, complementing OPEC cuts of similar size. Barron's notes:

“The shift in Russia’s strategy is surprising. At face value, and assuming no policy, supply or demand response, Russia’s actions could push Brent oil price to $90 already in April, reach mid-$90 by May and close to $100 in September, keeping pressure on the U.S. administration in the run-up to elections,” J.P. Morgan’s Natasha Kaneva said [in a note issued on Wednesday, March 27].

This is a curious, but not surprising, development. To date, the Kremlin has not pursued oil price maximization to finance the war. Therefore, the motivation now is likely different, and from the Kremlin's perspective, much more compelling. As Barron's and others point out, oil price increases appear designed to encourage US voters to reject Biden and elect Trump. This in turn reflects two implicit beliefs from Putin. First, the choice of US leader appears of paramount importance. That is, Putin believes Russia cannot defeat Ukraine unless the US abandons Kyiv. While this may be news in Republican circles, I have stated on several occasions that NATO's population is six times and its GDP is a staggering twenty-fives times that of Russia. Russia's taking on NATO would be akin to a 10 pound child taking on a 250 pound man. I take Putin as a reasonably intelligent man, and he appreciates Russia's odds are unfavorable if NATO, and in particular, the United States stands beside Ukraine. Electing Trump, therefore, is a key Kremlin priority.

Second, Putin appears to place supreme confidence in the actions of Trump were he re-elected. Why? Why would a Russian autocrat feel he can exercise absolute dominance over an elected US president? Why does Putin believe Trump and the US will be subservient to the Kremlin's wishes? When, in the entire history of the United States, did a US president crawl before a two-bit dictator?

Russia has been exploiting Republican paralysis in the US Congress to attack Ukraine at a murderous pace for the last six months, but at a high cost. According to Ukrainian official numbers, eliminated Russians now exceed 440,000, tank losses are approaching 7,000; armoured personnel carrier losses exceed 13,000; and more than 11.000 pieces of Russian artillery have been destroyed. Can Russia sustain this pace?

If one wants to assess the Kremlin's state of mind, there is no better source than Viktor Orbán, Hungary's Prime Minister and Putin's NATO mouthpiece. Last month, Orban suggested that Ukraine be left as a neutral buffer state between Russia and Europe. This can be taken as a Kremlin trial balloon to seek a settlement to the war. On March 15th, Putin added this:

"For us to hold negotiations now just because [the Ukrainians] are running out of ammunition would be ridiculous. Nevertheless, we are open to a serious discussion, and we are eager to resolve all conflicts, especially this one, by peaceful means."

In other words, Putin will discuss peace, but because the US is refusing to arm Ukraine, Putin wants better terms. Nevertheless, Putin is signalling that the war is beginning to wear Russia down. He is feeling for an exit, one which can only be achieved if the US abandons Kyiv. Therefore, Putin's strategy fundamentally depends on his influence over the Republican Party, and the Republican Party today is the creature of Donald Trump. As Putin feels confident in his ability to control Trump, re-electing Trump is central to Russian strategy. Hence the drive for $100 oil.

Some analysts have suggested the US could once again tap its strategic petroleum reserve to counteract Russian and OPEC+ production cuts. Is this feasible? The SPR was drawn at the pace of 1 mbpd in the early stages of the war, about as much as would be required to offset announced OPEC+ production cuts. As the graph below shows, such draws are not unprecedented, even in recent history.

Source: EIA

On the other hand, the SPR is depleted. The Biden administration has drawn down the reserve to only 55% of its normal levels. To counteract OPEC+ production cuts, we forecast the Biden administration would have to further reduce the SPR to about 200 million barrels, only ten days of US oil consumption and less than one-third of customary levels. In principle, this is possible. As a political matter, and more importantly, as a matter of prudent management, such draws appear problematic.

* Forecast assumes SPR is drawn at a pace of 1 mbpd to counteract Russian and OPEC+ oil supply cuts

Source: EIA, Princeton Policy forecasts

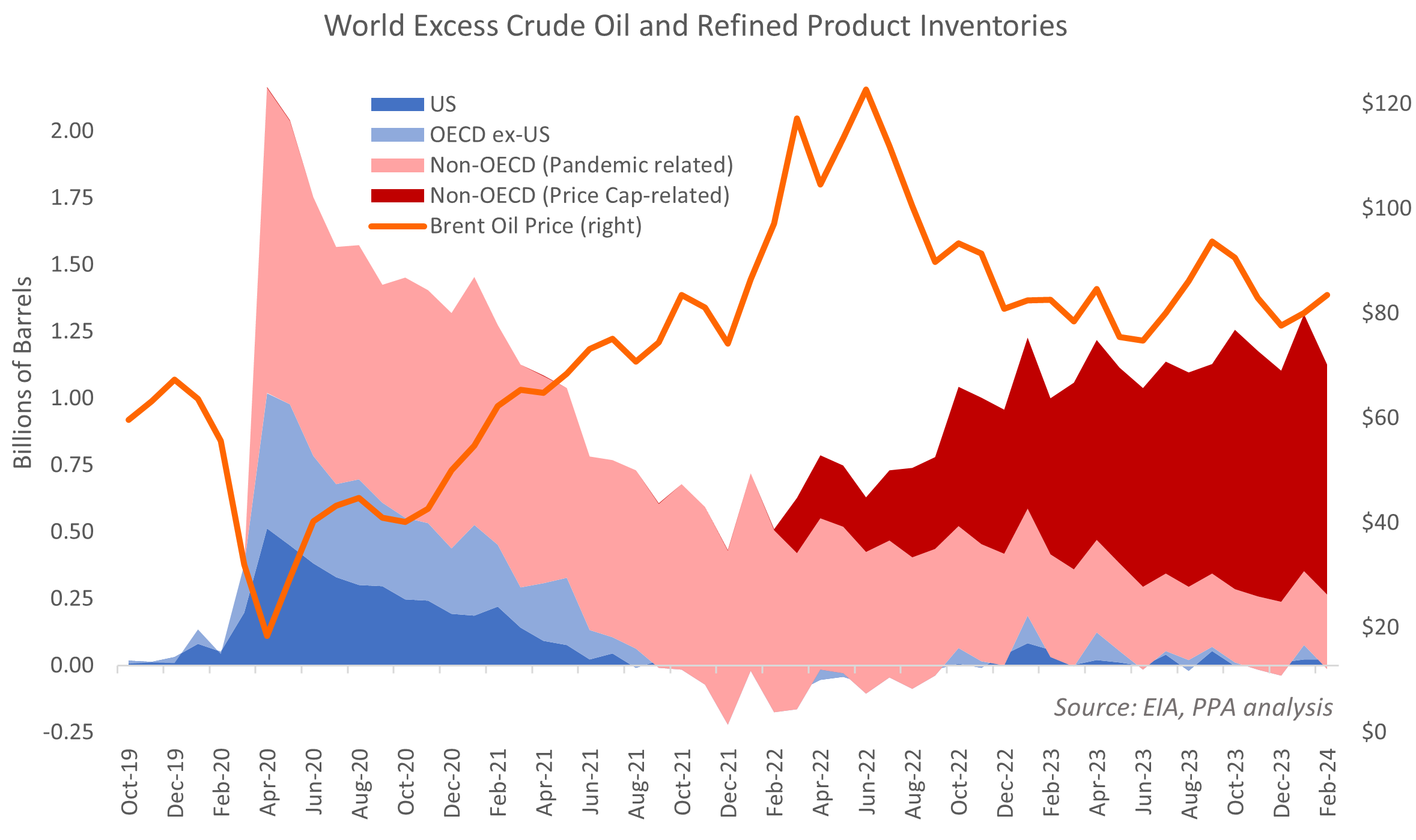

Importantly, the US would be drawing its strategic reserves even as massive amounts of excess crude are parked in the non-OECD countries, most notably China. As I noted earlier, excess crude inventories soared during the pandemic, largely owing to collapsed consumption. By late 2021, however, the US and other OECD countries had largely recovered, and inventories, as measured by days of turnover, had returned to normal levels. Not so in Asia. China's delayed re-opening kept excess inventories elevated, and the Russia-Ukraine war started before such excess crude inventories were fully run down. Instead, the Price Cap and Embargo offered an enormous incentive for Indian and Chinese traders to hoard oil, which they do to this day, to the tune of about 1 billion barrels above normal operating needs. Thus, the use of the SPR to counteract the Russia and OPEC+ production cuts would have the effect of gutting US strategic reserves even as Asia, and most notably China, is awash in speculative, excess crude, in addition to their own strategic reserves. And, of course, all this is happening in the context of a European war with serious risks of spreading to East Asia. Raiding the SPR to win the November election looks like bad policy and may even prove to be bad politics.

Source: Princeton Policy analysis of EIA STEO data

Meanwhile the Ukrainians continue to attack Russian oil refineries, reportedly causing a 4% loss of throughput and a 25% increase in Russian fuel prices. European Union fuel prices appear largely unaffected, although the Biden administration worries about retaliation against western energy infrastructure.

Source: European Commission, data through March 25

The dysfunction between Washington and Kyiv regarding policy towards the Russian oil business is essentially attributable to the misspecification of the Price Cap and Embargo. Were the Price Cap appropriately designed and implemented, Brent would effectively be capped at $75 / barrel through the US election in November. The excess inventories in Asia are all stored at logistics hubs and can easily be sold and delivered for consumption. The greater the OPEC+ production cuts, the faster excess crude inventories would flow into the market. Further, any increase in the price of oil would be beneficial to Ukraine, as a properly structured Price Cap mechanism would fully capture the value of the increased price. Brent at $100 / barrel would translate into an incremental $80 billion to Ukraine per year.

Finally, I would note the Kremlin's hostility to the US in attempting to raise oil prices to inflict damage on US consumers and tilt the US election. I would also bring attention to Business Insider's investigative piece on Havana Syndrome, which increasingly looks like attacks by Russian security services on US government employees and officials during peacetime. For those who think Russia is America's friend, I encourage you to read the article.

******

Oil Prices

Brent continues to show strength, closing on Monday at $87.75. Urals, Russian western crude oil export price, remains at $72, albeit with a lag in reporting due to the Easter holidays. Expect Urals to rise by $2 / barrel in the next few days.

If Brent crests and holds above $90, the Urals discount should shrink closer to $12 / barrel from the $14-15 discount seen in the last several weeks.

The Urals oil price remains the highest in the last nine years bar 2022.

Bottom line: Both Kyiv and the White House need to re-open the issue of the Price Cap and restructure it to Ukraine's and the Biden administration's advantage.