Oil influences the economy, and the state of the economy influences the balance of ideologies, which in turn establishes the boundaries of the politically possible. Italy in particular is in the news lately, with worries about its rising populism and a potential exit from the Euro. Much of the analysis is frankly wrong in our opinion. Given our traditional expertise in oil and years’ experience in Central Europe, we thought to weigh in.

Some of the most misleading oil markets analysis tends to come from Bloomberg, this time in an op-ed by Nathaniel Bullard, who writes, "demand for oil consumed for transportation is already waning in certain markets and segments...there’s Italy, where demand for gasoline has fallen by nearly half since 2005."

Bullard seems to think collapsing oil consumption is a virtue. It is not.

It is true that oil consumption per capita in Italy has fallen by 40% since Italy entered the Euro Zone in 1999. But how was this achieved?

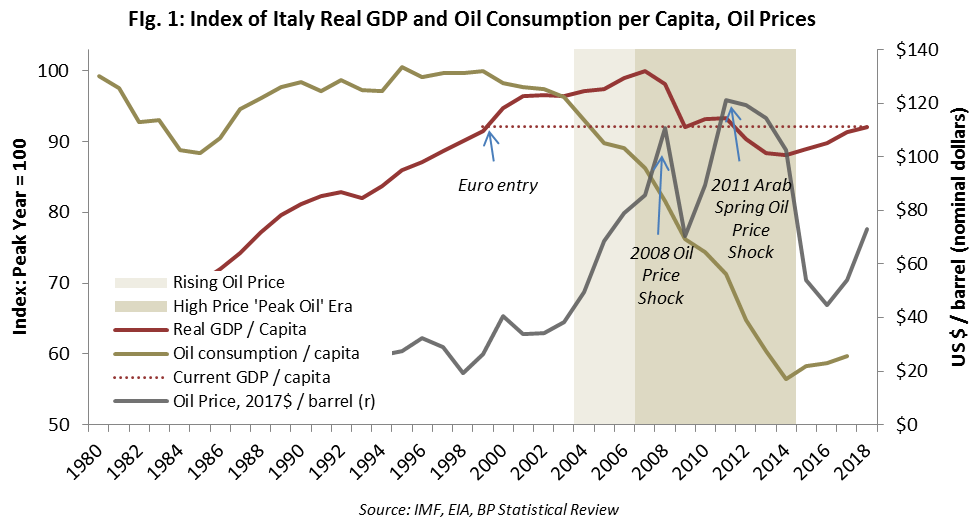

As the graph below shows, Italy’s oil consumption was relatively steady from 1980 until about 2004. In 2004, however, the global oil supply stalled and oil prices started a swift rise from around $38 / barrel (in 2017 dollars) to $80 / barrel by 2007. Italian oil demand began to crumble. Then, in 2008, oil prices spiked to historical highs, contributing to the greatest downturn since the Great Depression of the 1930s. Italy’s GDP fell by 8%. Oil consumption plunged.

With the country in recession through early 2009, Italy’s oil demand continued to drop, even as oil prices fell.

When the Great Recession officially ended in mid-2009, oil prices remained low and the global economy rallied. Italy caught its breath as GDP recovered a bit and oil consumption stabilized.

Underlying oil supply-demand fundamentals were essentially unchanged, however, and the return of global growth brought rising oil and commodity prices. This ultimately precipitated the 2011 Arab Spring and oil supply outages in various OPEC countries. Oil prices rebounded to historical highs on a sustained basis. Europe was again plunged into a recession, one which would last until Q1 2013 by official cycle dating. Italy’s oil consumption resumed its dive and GDP fell another 6 percentage points, bottoming in 2014 at 12 percent below its 2007 high. So, yes, Italy was able to reduce per capita oil consumption by 40%, at the cost of 12% of per capita GDP. If that’s success, well, call Italy a success.

Italy’s plight, of course, was not unique. Greece was worse. In fact, the entire OECD took it on the nose.

As the graph below shows, OECD oil consumption fell steadily from 2005 until 2014. During the initial phase from 2005 to the 2008 oil price shock, oil consumption fell by 4% or 2 mbpd (million barrels per day). But the real damage came the next year, in 2009, when the developed world was in deep recession and OECD oil consumption fell another 4 percent – an additional 2 mbpd – in a single year.

With lower oil prices in late 2009 and 2010, advanced country demand recovered briefly, only to be hammered again by the Arab Spring, which by 2014 had knocked another 0.6 mbpd off of OECD oil consumption.

How was this achieved? In every case, by high oil prices. There was no peak demand, just unrelenting price pressure, and the OECD economies were either in recession or suffering stagnation the whole time.

Now, where did all that OECD oil go? Only in 2009 did the oil supply dip briefly, and that was due to OPEC cuts in the face a collapsed oil prices. Otherwise, the oil supply saw no decline, and mostly growth, between 2005 and 2018. So where then did the ceded OECD oil consumption go? Of course, it’s obvious: to the non-OECD countries, principally to China.

Indeed, the entire 2005 to 2014 period can be characterized as a reallocation of global oil consumption from the developed economies to the emerging markets, with high prices stripping the advanced economies of their energy supply. During this time, OECD consumers provided a material share of China’s and other emerging economies’ increased oil consumption. Indeed, as the graph below shows, OECD consumers provided 80% of non-OECD oil consumption growth from 2005 to 2009. That is, 4 of every 5 incremental barrels consumed by, say, China did not originate in increased oil production, but by bidding away the oil consumption of the mature economies. Given the importance of oil, particularly as a monopoly fuel for transportation, the loss of oil consumption precipitated a major advanced economy recession. Notably, all the countries which experienced a financial crisis were net contributors of oil from consumers; none of the net recipients of oil suffered a financial crisis.

This reallocation lasted a long time. To the extent the stress has abated, the cause is clear: US shale oil production growth. The pressure for OECD consumers to cede consumption was mitigated by shale production growth rising to such a level that both the OECD and non-OECD economies had enough oil to go around. Indeed, US shales by themselves will represent, through 2019, 65% of global supply growth since 2005. Shales are not the icing on the cake, they are the cake. OPEC, Russia, Brazil and Canada are the icing. OPEC in particular will have added a meager 2.9 mbpd in the 2005-2019 stretch—an annual contribution of 0.2 percentage points of growth—and of this, about half was added only due to low oil price pressures resulting from US shale production growth.

Surging US oil production catalyzed an oil consumption and economic recovery for Italy (Figure 1) and for the OECD (Figure 2). After falling by 4.6 mbpd from 2005 to 2014, the US Energy Information Administration (EIA) sees OECD oil demand recovering from its trough by 2 mbpd through 2019. OECD oil consumption had little to do with ‘peak demand’, and everything to do with the oil price. Ample oil supplies allow Italy and the rest of the OECD to grow.

With this background, we can turn back to the particulars of Italy. Having entered the Euro Zone in 1999 (although tied to the ERM earlier), Italy was not in a position to devalue its currency when the recession hit. Instead, the Euro remained – and remains – a composite of the relative strengths of the Euro Zone countries, favorable to well-governed nations like Germany or the Netherlands, but brutal to the weak southern tier countries like Italy, Spain, and in particular, Greece. As a result, Italy could not solve its problems the historically convenient way, by devaluing the lira. Instead, it has had to cram down imports and attempt internal deflation.

The result: Italy’s GDP / capita today remains 8% below its 2007 high. Indeed, following IMF forecasts, the country’s GDP may not return to 2007 levels until the late 2020s – twenty years of stagnation. There is nothing unique about this. For example, the IMF forecasts that Puerto Rico, which is in a currency union with the United States, will see its 2024 GDP at 25% below the 2004 level. The Great Recession was most assuredly not a recession, but a depression. In many parts of the world, it persists as a practical matter to this day, as it does in Italy.

What then should Italy do? In southern tier European countries, the public distrusts their politicians, their government and their entire governance structure. For them, the Euro means Europe, the visible symbol that they are civilized people like Germans or Danes. Leaving the Euro would mark the Italians as a lesser people, behind not only the Germans and Dutch, but also the Spanish, the Slovaks and even countries like Romania and Bulgaria, which are signed up as eventual Euro members in the ERM II program. Euro membership is therefore first and foremost a matter of national pride and self-respect in Italy in a way it is not for, say, Switzerland, Norway or Great Britain. The Euro is a proxy for European governance.

The cost of such fealty, however, is an economy whose glory days are behind it. For this, the Italian public blames Brussels and Rome. For them, European math doesn’t work, as Italy’s GDP / capita is no higher today than when the country entered the Euro Zone almost twenty years ago.

If the traditional left and right are impotent, if Euro membership has brought only economic hardship, where should the public turn? Clearly, they are turning to unconventional solutions, to populists for example. These politicians promise that Italy can both retain the Euro and grow a heavily indebted economy with even more debt. The populists promise that they can defy the laws of arithmetic, and because conventional math has failed, Italians will give it a try.

If US shales can continue to grow production at their current pace for the next four years or so, then populism will likely fade and Italy will find some footing, even within the Euro Zone.

On the other hand, if US shale production under-performs, Italy may well fall into the oscillating extreme left and right populism which alt-right provocateur Steve Bannon sees as the wave of the future. A lack of oil for growth will provide ample room for populists to offer inherently contradictory, but superficially appealing, policies. Leaving the Euro Zone would be a better option in such an event.

In a recent debate with Bannon, conservative intellectual David Frum rejected Bannon’s populist apocalypse and stepped up to defend western liberalism. “It is absolutely clear that liberal democracy is in trouble now,” Frum said, “[but] the failures of a good system are not a reason to turn to an evil one. We have to review and repair.”

What should we review and repair, exactly? Is democracy the problem, or a lack of cheap oil?

Frum should have said, “Let’s hope US shales can supply as much oil as the world needs, for western liberalism hangs in the balance.” That would be closer to the truth.