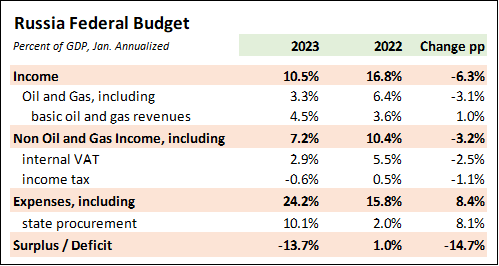

A month ago, the Russian government reported the federal budget deficit at 2.3% of GDP for 2022, suggesting that Russia was coping with the fiscal impact of the war rather easily. However, the annual numbers hid important trends. To begin with, the war started in late February, and as a result, Q1 financials were largely unaffected. Q2 saw high oil prices and stratospheric gas prices. By Q3, however, oil and gas prices were falling, and sales volumes were tapering. My earlier analysis of Q3 trend data suggested a 10% budget deficit at the time, but it was not clear whether this was in fact the case.

The January fiscal data suggest the Russian budget is indeed under considerable stress. The Russian Ministry of Finance reported that, compared to January 2022, total federal government revenues are down 35%, and within this, oil and gas revenues are down 46% and tax revenues have fallen 28%. That would be bad enough.

However, the spending side is also out of control, with January expenses up 59% on January 2023, in large part associated with keeping hundreds of thousands of troops armed and fed in the field. The result is a budget deficit running at a pace of 13.7% of GDP. That is very large for a country without access to global credit markets.

Russia still has various bank reserves, some ability to raid the coffers of state-owned companies like Gazprom and Rosneft, and the balance of Russia’s sovereign wealth fund. This latter fund is reported to have a balance of $148 bn as of last month, that is, enough to cover half the deficit Russia would incur in 2023 if January’s deficit proves typical for the balance of the year. As a result, the sovereign wealth fund will likely be drawn down to near zero, if not in 2023, then likely by mid-2024. Putin’s reluctance to call another mobilization may be related to financial constraints, as conscripting half a million working age men and provisioning them in the field could only make the deficit that much worse.

A recovering oil market may yet save Russia, but for the moment, oil prices remain restrained and the price cap appears effective. Without materially higher oil prices, Russia faces difficult fiscal conditions in 2023. By 2024, the situation is likely to be dire.